SMM Alumina Morning Comment, April 23

Futures: In the night session, the most-traded alumina 2509 contract opened at 2,806 yuan/mt, with a high of 2,845 yuan/mt and a low of 2,806 yuan/mt, closing at 2,837 yuan/mt, up 25 yuan/mt, or 0.90%, with an open interest of 222,000 lots.

Ore: As of April 22, the SMM imported bauxite index stood at $86.88/mt, flat from the previous trading day. The SMM Guinea bauxite CIF average was $86/mt, flat from the previous trading day. The SMM Australia low-temperature bauxite CIF average was $87/mt, flat from the previous trading day. The SMM Australia high-temperature bauxite CIF average was $80/mt, flat from the previous trading day.

Spot Alumina: On Tuesday, 2,000 mt of alumina was traded in Shandong at an ex-factory price of around 2,865 yuan/mt.

Industry News:

- According to financial reports, Alcoa achieved revenue of $3.37 billion in Q1 2025, up 29.6% YoY, with a net profit of $548 million, compared to a net loss of $252 million in the same period last year. Despite turning a profit, the net profit level fell short of market expectations. The report showed that Alcoa lost about $20 million in Q1 due to tariffs. Its CEO, William Oplinger, stated in a conference call that about 70% of the aluminum produced by Alcoa in Canada is sold to the US market, and this part of the business is currently subject to hefty import tariffs. Alcoa said that the US tariffs on aluminum imports from Canada are expected to result in a loss of about $90 million in Q2. Additionally, as some raw materials come from Chinese suppliers and there is currently a lack of alternatives, the hefty tariffs on Chinese aluminum products are expected to increase the company's annual costs by $10 million to $15 million.

- According to statistics released by the National Energy Administration on April 20, 2025, the new PV installations in China from January to March 2025 were 59.71 GW (or 59.71 million kW), up 30.5% YoY.

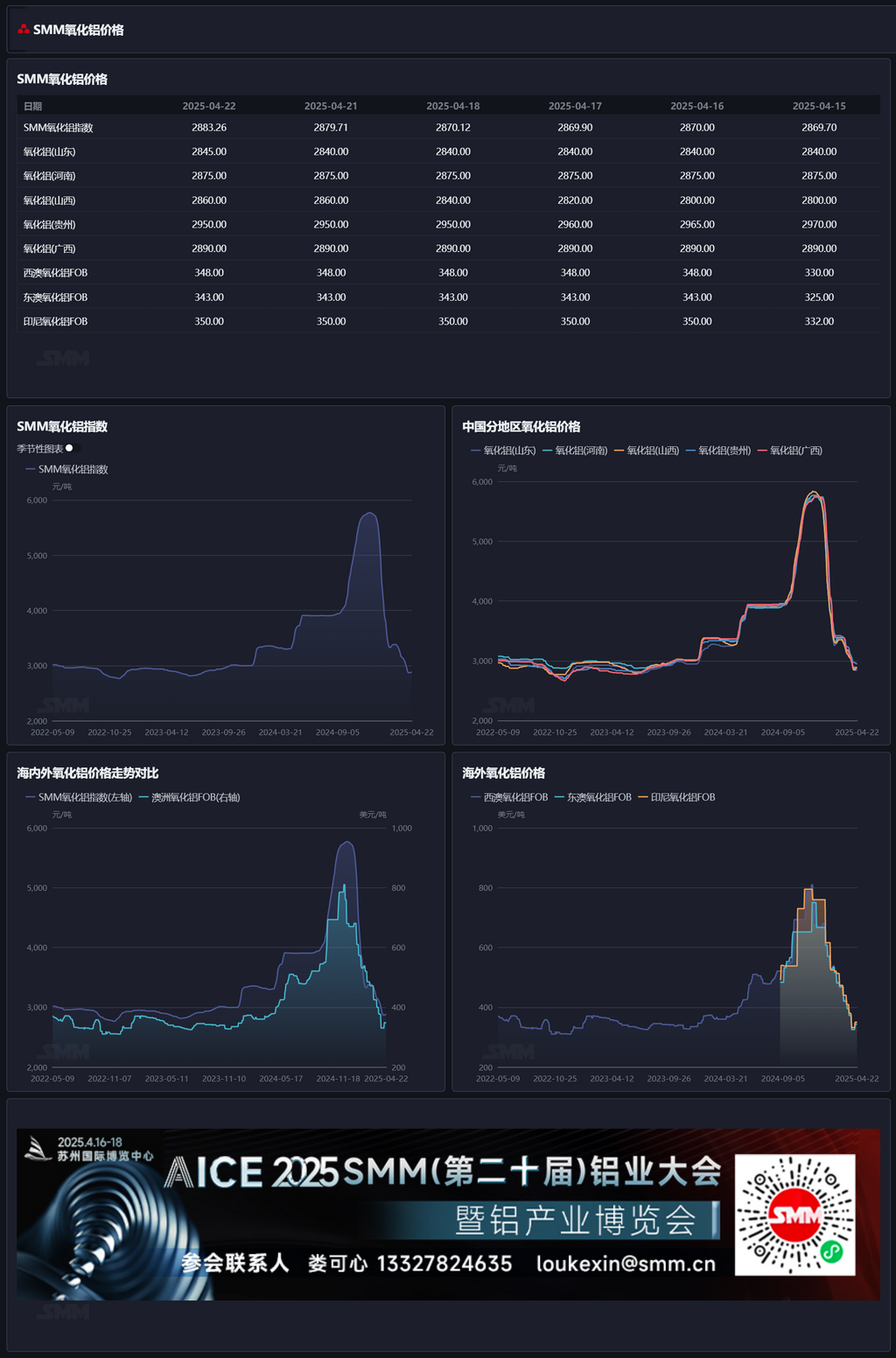

Spot-Futures Price Spread Report: According to SMM data, on April 22, the SMM alumina index was at a premium of 89 yuan/mt against the latest transaction price of the most-traded contract at 11:30.

Warrant Report: On April 22, the total registered alumina warrants increased by 888 mt to 288,500 mt. The total registered alumina warrants in Shandong remained flat at 3,307 mt. The total registered alumina warrants in Henan decreased by 901 mt to 8,100 mt. The total registered alumina warrants in Guangxi remained flat at 41,700 mt. The total registered alumina warrants in Gansu remained flat at 16,500 mt. The total registered alumina warrants in Xinjiang increased by 1,789 mt to 218,900 mt.

Overseas Market: As of April 22, 2025, the FOB Western Australia alumina price was $348/mt, with an ocean freight rate of $20.55/mt. The USD/CNY exchange rate selling price was around 7.33, translating to a domestic mainstream port selling price of about 3,133 yuan/mt, 249 yuan/mt higher than the domestic alumina price, keeping the alumina import window closed.

Summary: Due to concentrated maintenance at alumina refineries in April, the operating capacity of alumina has continued to decline, dropping to 82.88 million mt/year as of last week. The tightening supply of alumina in the short term has slowed the decline in alumina prices, with a slight rebound in northern alumina prices. Recently, some companies have completed their maintenance, and new maintenance and production cuts have also occurred. Short-term prices are expected to fluctuate. With the completion of subsequent maintenance and the commissioning of new capacities, the operating capacity of alumina is expected to rebound, but medium and long-term alumina prices remain under pressure.

[The information provided is for reference only. This article does not constitute direct advice for investment research decisions. Clients should make decisions cautiously and not use this as a substitute for independent judgment. Any decisions made by clients are unrelated to SMM.]